PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information contained elsewhere or incorporated by reference in this prospectus and in the documents we incorporate by reference.

This summary does not contain all of the information that you should consider before deciding to invest in our common stock. You should read the entire prospectus carefully, including the “Risk Factors” section contained in this prospectus

supplement, the “Risk Factors” section contained in the documents incorporated by reference herein, and our consolidated financial statements and the related notes and the other documents incorporated by reference herein, before making an

investment decision. Unless the context requires otherwise, references in this prospectus to “Pieris Pharmaceuticals,” “Pieris,” “the company,” “we,” “us,” and “our” refer to Pieris

Pharmaceuticals, Inc. and, where appropriate, our consolidated subsidiaries.

Company Overview

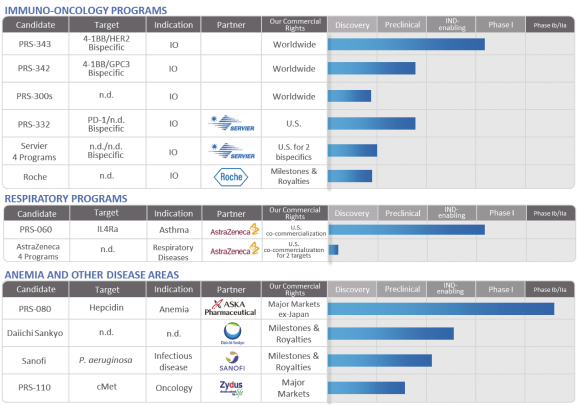

We are a clinical stage biotechnology company that discovers and develops Anticalin-based drugs to target validated disease pathways in a unique and

transformative way. Our pipeline includes immuno-oncology multi-specifics tailored for the tumor microenvironment, an inhaled Anticalin protein to treat uncontrolled asthma and a half-life-optimized Anticalin protein to treat anemia. Our proprietary

Anticalin proteins are a novel class of protein therapeutics validated in the clinic and by partnerships with leading pharmaceutical companies.

Anticalin

proteins are a class of low molecular-weight therapeutic proteins derived from lipocalins, which are naturally occurring, low-molecular weight human proteins typically found in blood plasma and other bodily

fluids. Anticalin proteins function similarly to monoclonal antibodies, or mAbs, by binding tightly and specifically to a diverse range of targets. An antibody is a large protein used by the immune system that recognizes a unique part of a foreign

target molecule, called an antigen. We believe Anticalin proteins possess numerous advantages over antibodies in certain applications. For example, Anticalin proteins are small in size and are monomeric, meaning they consist of single protein units

rather than a multi-protein complex. Therefore, we believe Anticalin proteins are generally more stable biophysically than tetrameric monoclonal antibodies, which are composed of four protein subunits. The greater biophysical stability of Anticalin

proteins potentially enable unique routes of drug administration such as pulmonary delivery. Higher-molecular-weight entities, such as antibodies, are often too large to be delivered effectively through these methods. In addition, Anticalin proteins

are monovalent in structure, which means they bind to a single cell surface receptor, which may avoid the risk of cross-linking of cell surface receptors where such receptors are a therapeutic target. While our basic Anticalin proteins have only a

single binding site and are not subject to such cross-linking, the Anticalin technology is also modular, which allows us to design Anticalin protein constructs to bind with specificity to multiple targets at the same time. This multispecificity

offers advantages in biological settings where binding to multiple targets can enhance the ability of a drug to achieve its desired effects, such as killing cancer cells. Moreover, unlike antibodies, the pharmacokinetic, or PK, profile of Anticalin

proteins can be adjusted to potentially enable program-specific optimal drug exposure. Moreover, no immunogenicity has been observed to date with Anticalin proteins. Such differentiating characteristics suggest that Anticalin proteins have the

potential, in certain cases, to become first-in-class drugs. We believe that the drug-like properties of the Anticalin drug class were demonstrated in various clinical

trials with different Anticalin-based drug candidates, including PRS-050, PRS-080, and others.

We have collaboration arrangements with major multi-national pharmaceutical companies headquartered in the United States Europe, and Japan. These include

existing agreements with Seattle Genetics, Inc., or Seattle Genetics, AstraZeneca AB, or AstraZeneca, Les Laboratoires Servier and Institut de Recherches Internationales Servier, or Servier, Daiichi Sankyo Company Limited, or Daiichi, Sanofi Group,

or Sanofi, and F.Hoffmann-La Roche Ltd. and Hoffmann-La Roche Inc., or Roche. We also entered into an exclusive option agreement with ASKA Pharmaceutical Co., Ltd., or ASKA for rights to PRS-080 in Japan and

certain other Asian territories. We also have discovery and preclinical collaboration and service agreements with both academic institutions and private firms across the globe, though Pieris Pharmaceuticals, Inc., Pieris Pharmaceuticals GmbH and

Pieris Australia Ptd Ltd.