Pieris Pharmaceuticals, Inc. Nasdaq:PIRS January 2016 Corporate Presentation Exhibit 99.1

Forward Looking Statements Statements in this presentation that are not descriptions of historical facts are forward-looking statements that are based on management’s current expectations and assumptions and are subject to risks and uncertainties. In some cases, you can identify forward-looking statements by terminology including “anticipates,” “believes,” “can,” “continue,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or the negative of these terms or other comparable terminology. Factors that could cause actual results to differ materially from those currently anticipated include, without limitation, risks relating to the results of our research and development activities, including uncertainties relating to the discovery of potential drug candidates and the preclinical and clinical testing of our drug candidates; the early stage of our drug candidates presently under development; our ability to obtain and, if obtained, maintain regulatory approval of our current drug candidates and any of our other future drug candidates; our need for substantial additional funds in order to continue our operations and the uncertainty of whether we will be able to obtain the funding we need; our future financial performance; our ability to retain or hire key scientific or management personnel; our ability to protect our intellectual property rights that are valuable to our business, including patent and other intellectual property rights; our dependence on third-party manufacturers, suppliers, research organizations, testing laboratories and other potential collaborators; our ability to successfully market and sell our drug candidates in the future as needed; the size and growth of the potential markets for any of our approved drug candidates, and the rate and degree of market acceptance of any of our approved drug candidates; developments and projections relating to our competitors and our industry; our ability to establish collaborations; our expectations regarding the time which we will be an emerging growth company under the JOBS Act; our use of proceeds from this offering; regulatory developments in the U.S. and foreign countries; and other factors that are described more fully in our preliminary prospectus filed with the SEC on June 17, 2015. In light of these risks, uncertainties and assumptions, the forward-looking statements regarding future events and circumstances discussed in this report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. The forward-looking statements included in this presentation speak only as of the date hereof, and except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this presentation to conform these statements to actual results or to changes in our expectations. Non-confidential

Pieris Pharmaceuticals Corporate Profile We own a next generation therapeutic protein drug class, Anticalins® Addressing validated targets in a unique and transformative way Clinical validation demonstrates excellent drug-like properties Our rapidly advancing proprietary pipeline addresses large markets Immuno-oncology bispecific tailored for the tumor micro-environment Inhaled Anticalin to treat uncontrolled asthma Half-life-optimized Anticalin to treat anemia We have an excellent cadre of investors and R&D partners OrbiMed Advisors (18%), Tekla Capital Management (10%), Lombard Odier (7%), Omega Funds (6%) Roche, Sanofi, Daiichi, etc: >$50 million in non-dilutive funding to date and combined milestone potential of $>700 million Our unique multispecifics platform provides broad potential for attractive partnerships in immuno-oncology and other areas Non-confidential

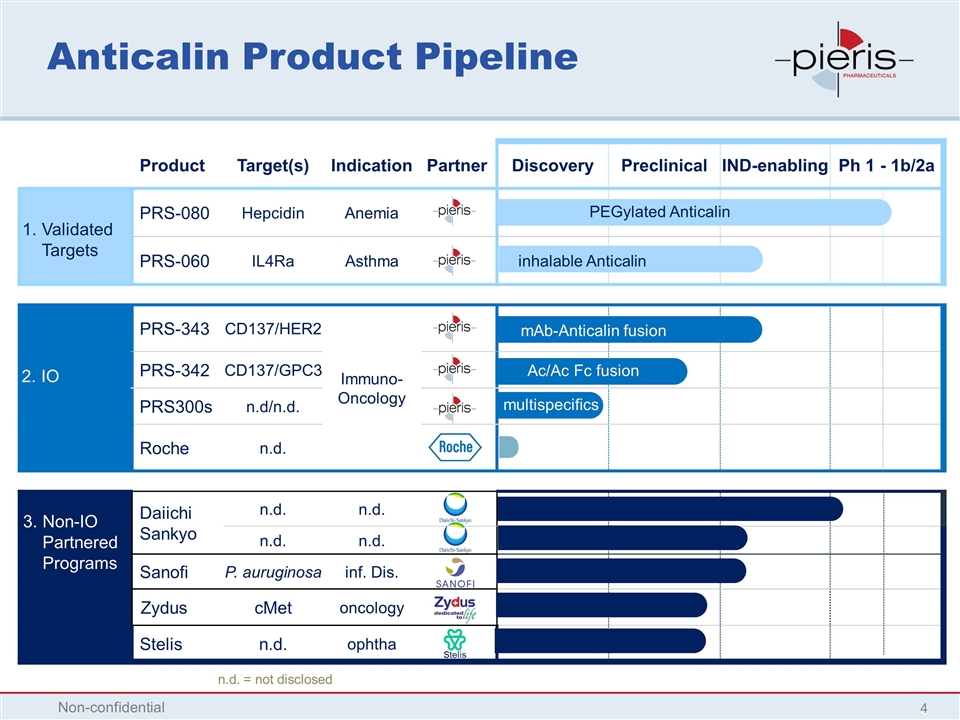

Anticalin Product Pipeline Product Target(s) Indication Partner Discovery Preclinical IND-enabling Ph 1 - 1b/2a PRS-080 Hepcidin Anemia PRS-060 IL4Ra Asthma PRS-343 CD137/HER2 Immuno-Oncology PRS-342 CD137/GPC3 PRS300s n.d/n.d. Roche n.d. Daiichi Sankyo n.d. n.d. n.d. n.d. Sanofi P. auruginosa inf. Dis. Zydus cMet oncology Stelis n.d. ophtha n.d. = not disclosed PEGylated Anticalin inhalable Anticalin mAb-Anticalin fusion Validated Targets IO Non-IO Partnered Programs Non-confidential Stelis Ac/Ac Fc fusion multispecifics

Anticalins Platform Basics Non-confidential

Anticalins are a Novel Class of Therapeutic Binding Proteins Anticalin in complex with a small molecule (Y-DTPA) Anticalin bound to the hepcidin peptide Anticalin bound to the CTLA4 protein Anticalins® are derived from lipocalins – human extracellular binding proteins Small (18 kDa vs 150 kDa mAbs), high selectivity and potency Anticalins Have Been Generated Against a Broad Range of Targets Lipocalin Non-confidential

Differentiating Features Human-derived √ √ Natural binding molecule √ √ Non-immunogenic √ √ High affinity and specificity √ √ Systemic delivery √ √ Tunable pharmacokinetics (√) √ Local delivery (e.g., inhalation) √ Versatile multispecifics √ Protein class exclusivity √ Positive freedom to operate landscape √ Anticalins Share Several Features with mAbs yet are Highly Differentiated Monoclonal Antibodies (mAbs) are highly successful drugs Anticalins share many of the beneficial properties of mAbs yet are highly differentiated Antibody Anticalin Safety Related Efficacy Related IP Related Non-confidential

Anticalin-Based Drug Candidates Have Been Tailored to Multiple Formats Pure Anticalin formats Multispecific mAb-Anticalin formats Multispecific Fc-Anticalin formats Bispecific Trispecific Tetraspecific Tetracalin Anticalin Tricalin Duocalin Bispecific Trispecific Tetraspecific Drug candidates with potent multi-target engagement & excellent drug-like properties Binding site geometry and valency designed to address biological and clinical needs Non-confidential 9

Anticalins in Immuno-Oncology Differentiation Through Unique Multispecific Formats Non-confidential

Pieris’ Unique Costimulatory Approach – Steering Immune Activation to the TME Non-Confidential Systemic Exposure Tumor Microenvironment Immune System The Break CTLA-4 Undisclosed targets The Gas Pedal CD137 / 4-1BB Undisclosed targets The Steering Wheel Tumor targeting: HER2 GPC3 Undisclosed targets

PRS-343: HER2-CD137 Bispecifics Target Rationale for Lead IO Program CD137 – a TNFR Costimulatory Target Preclinically and clinically validated Marker for tumor-reactive T cells Activation leads to tumor elimination in vivo Pure mAb approaches are sub-optimal Systemic immune system engagement Doses required for T cell activation have led to severe toxicity HER2 – Validated but not fully exploited Restricted expression on normal tissue favors immunotherapy approach Several HER2+ tumors nonresponsive to approved anti-HER2 therapies Bladder, Gastric, Endometrial, Breast, etc. Several nonresponders have CD137+ TILs (T cells in tumor microenvironment) Non-confidential MHC-peptide Her2 Tumor Cell T cell receptor CD137 Clustering contributes to T Cell activation Tumor-specific T Cell

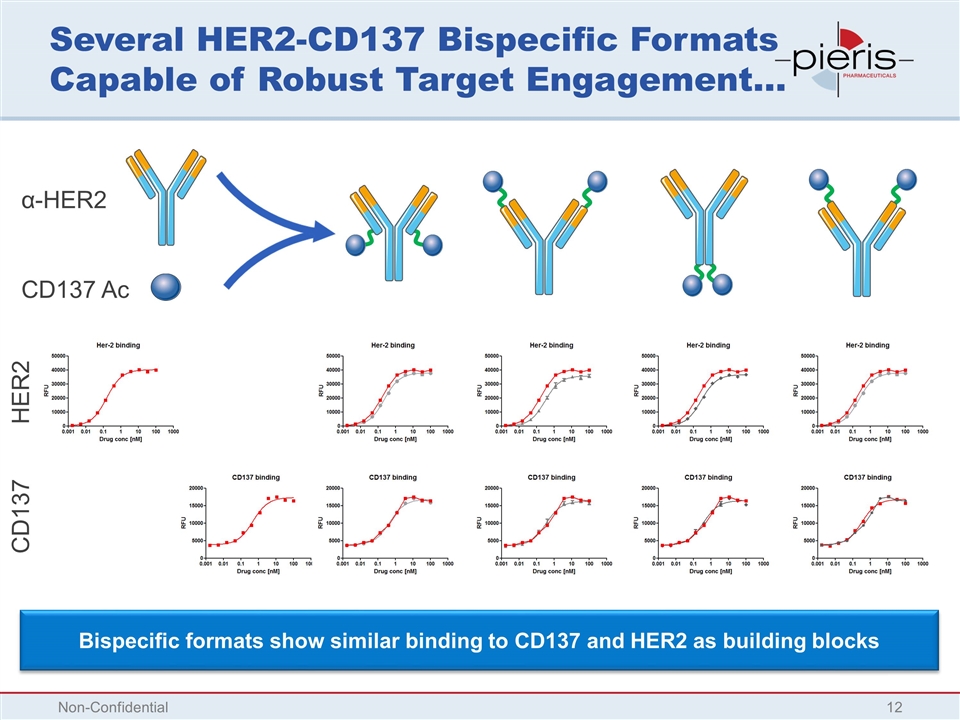

Several HER2-CD137 Bispecific Formats Capable of Robust Target Engagement... Non-Confidential α-HER2 CD137 Ac HER2 CD137 Bispecific formats show similar binding to CD137 and HER2 as building blocks

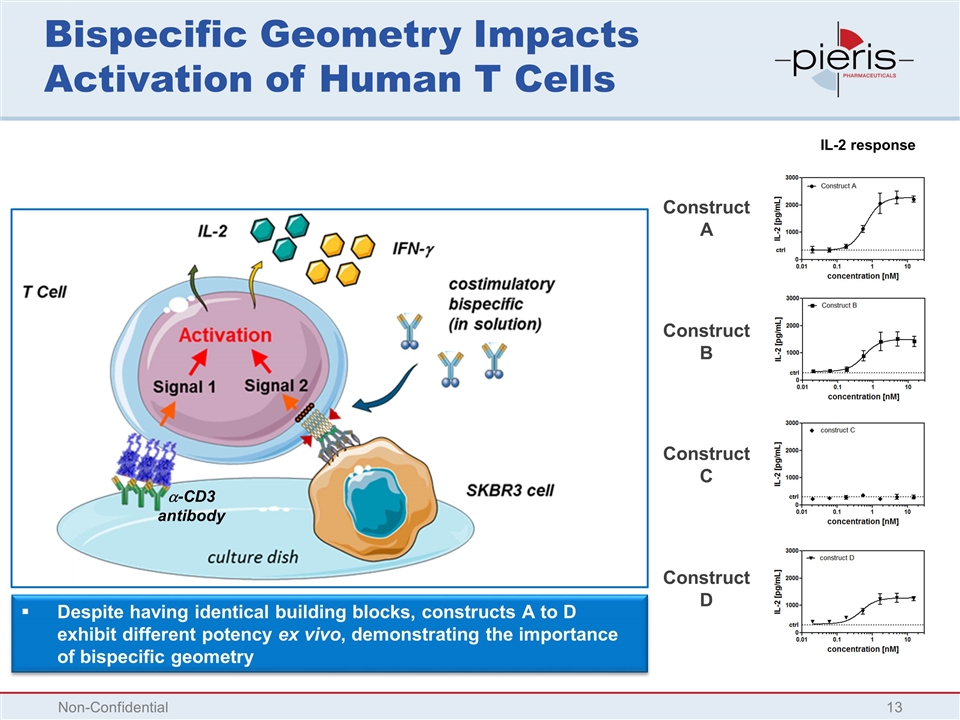

Bispecific Geometry Impacts Activation of Human T Cells IL-2 response Construct A Construct B Construct C Construct D Non-Confidential Despite having identical building blocks, constructs A to D exhibit different potency ex vivo, demonstrating the importance of bispecific geometry a-CD3 antibody

T Cell Activation is HER2 Target-Dependent Construct A Construct B Construct C Construct D Non-Confidential IL-2 response with Her2 blockade Excess trastuzumab Addition of excess HER2-targeting trastuzumab prevents PRS-343 binding to HER2-positive cells and results in a loss of activity, as intended, confirming mode of action a-CD3 antibody

PRS-343 Status and Next Steps Development candidate nominated Demonstrated ability to activate human T cells consistent with desired mode of action Potent, tumor-dependent activation Differentiation over anti-CD137 mAbs Desired drug-like properties CMC: Robust titers and long-term stability Low risk of immunogenicity Antibody-like half-life in mouse and cynomolgus monkey IND-enabling activities underway First-in-Patient Study planned for 1H17 HER2+ solid tumor patients Non-confidential

PRS-342: GPC3-CD137 Bispecific Target Rationale for GPC3 as Tumor Target Non-Confidential Glypican 3 (GPC3) is an oncofetal antigen with almost no expression in normal adult tissue, therefore favoring a tumor-targeted immunotherapy approach Thought to be involved in modulation of growth in the predominantly mesodermal tissues and organs during development Glypican Target Biology Expression is pronounced in multiple cancers that are known to have CD137+ TILs Hepatocellular Carcinoma (HCC): Overexpressed in 60-80% of lesions with no expression in healthy liver tissue; correlated with poor prognosis Merkel Cell Carcinoma: Overexpressed in 80% of tumors Melanoma: Overexpressed in 40-80% of melanoma lesions

PRS-342: GPC3-CD137 Bispecific Different Formats Under Preclinical Evaluation Non-Confidential Anti-CD137 Anticalin Anti-GPC3 Anticalin IgG4 Fc variant Protease-resistant, non-immunogenic linkers PRS-342

PRS-342 Bispecific Tumor-dependent T Cell Activation Non-Confidential Representative PRS-343 bispecific construct IL-2 response Without GPC3 blockade concentration [µg/mL] IL-2 response with GPC3 blockade concentration [µg/mL] culture dish Signal 2 Signal 1 Activation Hep3B cell (GPC3-pos.) PRS-343 construct T Cell a-CD3 antibody IL-2 +/- GPC3 blockade PRS-342 is a first-in-class bispecific that targets highly unmet patient populations and demonstrates that our Anticalin-based co-stimulatory approach is repeatable

NEWS: First IO Partnership Roche – The Global Oncology Leader Scope: One-target but potentially multi-program Roche solely responsible starting from IND-enabling studies Financial: Pieris receives upfront payment of ~US$6.5 million Roche fully funds collaborative research phase Total potential deal could exceed US$400 million Majority of agreed payments for development milestones Not including royalties, which are up to low double-digit Strategic Implications: Validation of Anticalins® in IO by industry leader Ability to sign additional partnerships Free cash flow to advance proprietary programs Non-confidential

Anticalin Programs in Other Disease Areas Novel approaches to validated disease targets Non-confidential

PRS-080: Best-in-Class Hepcidin Antagonist For Functional Iron Deficient Anemia (FID) Hepcidin is a 25 amino acid peptide hormone that serves as a key regulator of iron metabolism by inhibiting iron entry into plasma from the three main sources of iron: Dietary absorption in the duodenum Release of recycled iron from macrophages Release of stored iron from hepatocytes Non-Confidential Information Haematologica 2013 98:11 Hepcidin elevation a hallmark of anemias of chronic disease

PRS-080-mediated Hepcidin Inhibition Mobilizes Iron for Red Blood Cell Production Hepcidin is a clinically validated anemia target The pegylated Anticalin PRS-080 is a potent hepcidin antagonist designed to reverse hepcidin-mediated anemia by mobilizing iron trapped in iron storage cells Established biomarkers (e.g. ferritin, TSAT, hepcidin) used to find & monitor patients Addresses patients poorly responsive to ESA and iron therapies PK profile (half-life) of PRS-080 designed for a best-in-class approach Iron Ferroportin Inflammation Hepcidin PRS-080 PRS-080 Non-confidential

PRS-080: Successfully Completed Ph I and Advancing Into Patients Non-confidential Ph I study highlights (Presented ASH 2015) Safe and well tolerated in 48 healthy volunteers Six dose levels – 0.08 to 16.0 mg/kg, i.v. No reported severe adverse events (SAE) No risk of immunogenicity observed Confirmation of desired 3-day half-life Confirmation of mode of action Immediate, dose-dependent decrease in circulating hepcidin Dose-related duration of serum iron and TSAT responses (24-120 h) Robust iron responses at doses of 1.2 mg/kg and above, with statistically significant increase in total serum iron mobilization relative to placebo (p = .005) First-in-patient study in hemodialysis-dependent ESRD patients having FID anemia: patient recruitment commencing Q1 2016

PRS-080: US Market Opportunity in Chronic Kidney Disease (Stage 5) Sources: USRDS 2014 Annual Data Report (2012 numbers): Atlas of Chronic Kidney Disease and End-Stage Renal Disease in the U.S Competitive Landscape Report, Tech Atlas Group, September 2013; Artisan Healthcare Consulting market research study 2013 CKD Stage 5 Patients (Total 640K in U.S.) No anemia 30% Anemic 70% CKD Stage 5 Patients with Anemia (Total 450K in U.S.) FID 20% No FID 80% Target Functional Iron-Deficient (FID) population in U.S. is ~ 90,000 patients We believe treating FID anemic patients has large commercial potential Non-confidential

PRS-060: First-in-Class Inhaled Anticalin Targeting IL-4Ra For Uncontrolled Asthma Adapted from Wenzel, Nature Medicine 18, 716–725 (2012) IL4Ra is a clinically validated asthma target, mediating IL4 & IL13 TH2 signaling PRS-060 designed to antagonize IL4Ra specifically in the lung, bypassing on-target-off-tissue engagement à inhaled delivery and short plasma half-life Biomarkers (e.g., exhaled nitric oxide) can be used to find & monitor patients Addresses patients uncontrolled on standard of care (inhaled ICS/LABA) Local delivery (inhalation) of PRS-060 for a first-in-class approach TH2 immune processes in the airways of people with asthma PRS-060 blocks PRS-060 blocks PRS-060 blocks

PRS-060: Potent in vivo Target Inhibition Following Pulmonary Delivery in TG Mice Expressing Human IL-4Ra/IL-13R Early onset of inhibition and durability of effect up to 24h post pulmonary administration Low pulmonary dose of PRS-060 (3.1 µg) is effective Superior inhibition by PRS-060 compared to pitrakinra (discontinued competitor product) Relative Eotaxin Expression Relative Eotaxin Expression Inhibition of IL-13-induced eotaxin expression in the lung by pulmonary administration of PRS-060 PRS-060 IL-4 mutant (pitrakinra) Time of single treatment prior to IL-13 challenge Single treatment 30 min prior to IL-13 challenge, µg administered PRS-060

PRS-060: Positive Preclinical Data and Advancing Toward the Clinic Non-confidential Preclinical data highlights In vivo proof of concept in transgenic mouse model PRS-060 significantly reduced inflammation marker (IL13-induced eotaxin expression) up to 24 hrs after single dose via pulmonary administration Early onset of inhibition (< 0.5 hr) Low systemic exposure and short plasma half-life (2.7 hr) following pulmonary administration in mice Feasibility of local delivery (nebulization and spray drying) demonstrated Appropriate particle size with no aggregation High yield with full functional activity Clear differentiation from injected mAbs IND-enabling studies underway First-in-man study (nebulized formulation) planned for 1H 2017 Total PRS-060 following inhalation [µg]

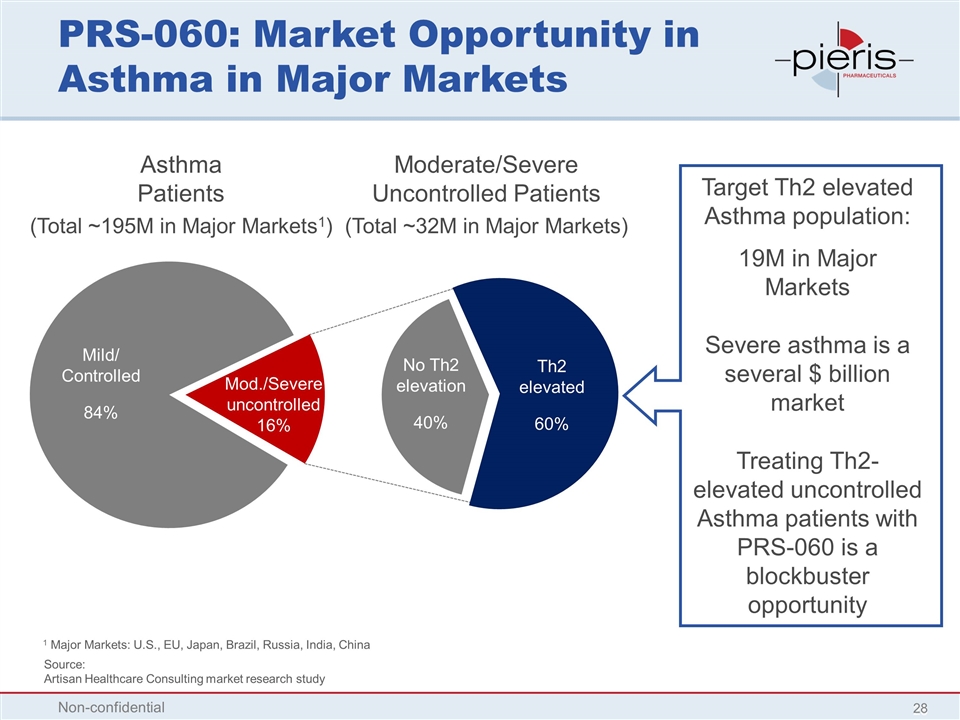

PRS-060: Market Opportunity in Asthma in Major Markets 1 Major Markets: U.S., EU, Japan, Brazil, Russia, India, China Asthma Patients (Total ~195M in Major Markets1) Mild/ Controlled 84% Mod./Severe uncontrolled 16% Moderate/Severe Uncontrolled Patients (Total ~32M in Major Markets) Th2 elevated 60% No Th2 elevation 40% Target Th2 elevated Asthma population: 19M in Major Markets Severe asthma is a several $ billion market Treating Th2-elevated uncontrolled Asthma patients with PRS-060 is a blockbuster opportunity Source: Artisan Healthcare Consulting market research study Non-confidential

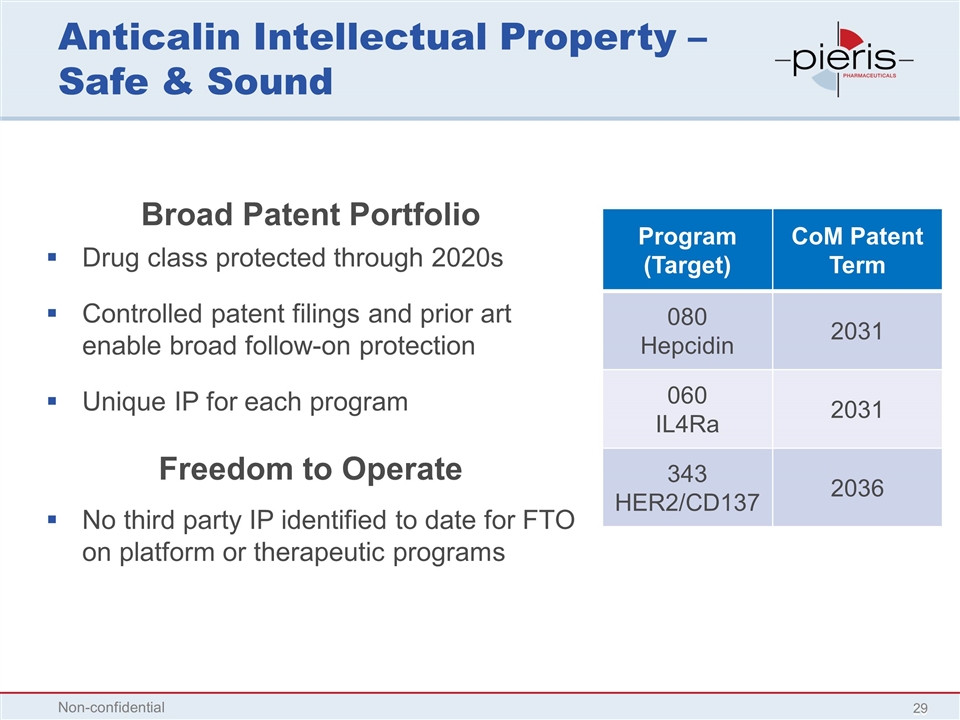

Anticalin Intellectual Property – Safe & Sound Broad Patent Portfolio Drug class protected through 2020s Controlled patent filings and prior art enable broad follow-on protection Unique IP for each program Freedom to Operate No third party IP identified to date for FTO on platform or therapeutic programs Program (Target) CoM Patent Term 080 Hepcidin 2031 060 IL4Ra 2031 343 HER2/CD137 2036 Non-confidential

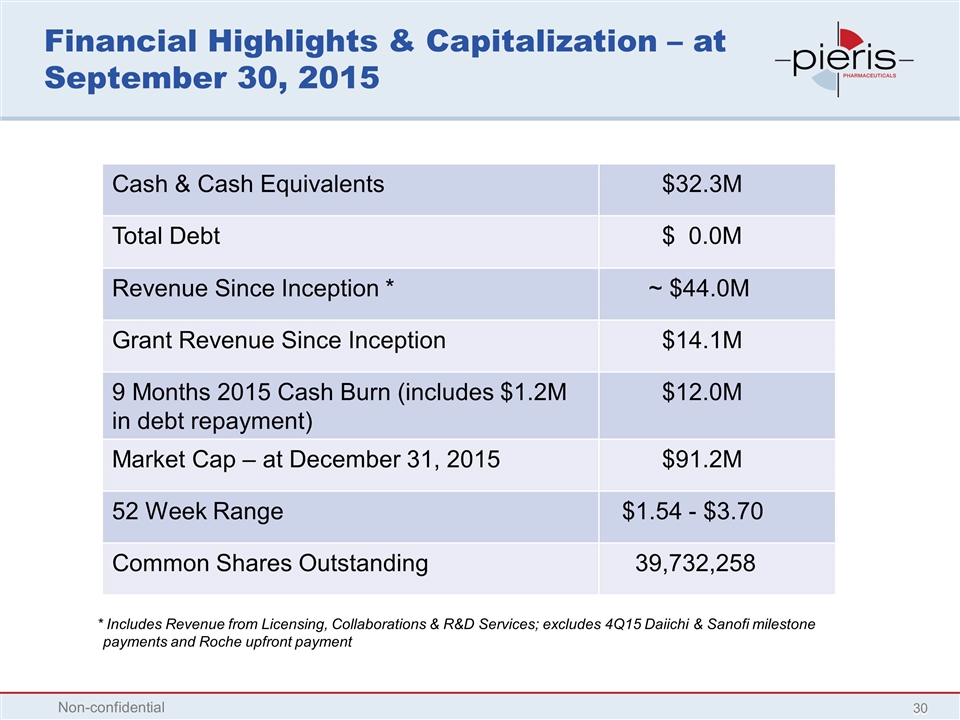

Financial Highlights & Capitalization – at September 30, 2015 Non-confidential Cash & Cash Equivalents $32.3M Total Debt $ 0.0M Revenue Since Inception * ~ $44.0M Grant Revenue Since Inception $14.1M 9 Months 2015 Cash Burn (includes $1.2M in debt repayment) $12.0M Market Cap – at December 31, 2015 $91.2M 52 Week Range $1.54 - $3.70 Common Shares Outstanding 39,732,258 * Includes Revenue from Licensing, Collaborations & R&D Services; excludes 4Q15 Daiichi & Sanofi milestone payments and Roche upfront payment

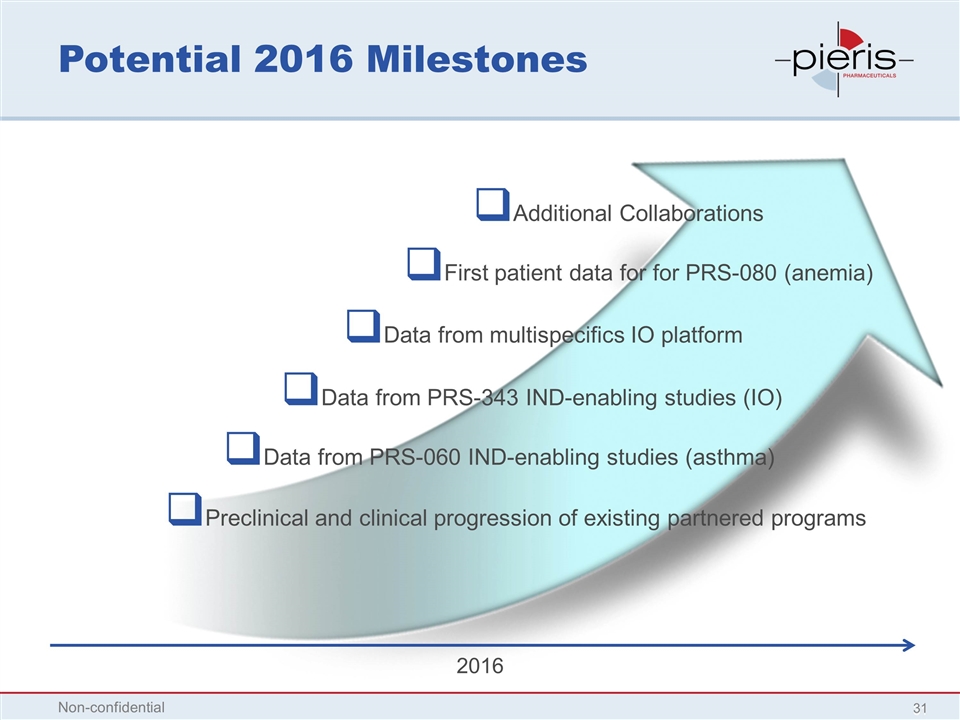

2016 Preclinical and clinical progression of existing partnered programs Data from PRS-060 IND-enabling studies (asthma) Additional Collaborations Potential 2016 Milestones Non-confidential First patient data for for PRS-080 (anemia) Data from PRS-343 IND-enabling studies (IO) Data from multispecifics IO platform

Pieris Pharmaceuticals, Inc. 255 State Street, 9th Floor Boston, MA 02109 USA info@pieris.com Non-confidential